On June 8th, 2009, this blog posted an article entitled Is the de-listing of UEM Group a cover-up for a major loss? prior to the appointment of Dato Izzadin as UEM Group new CEO.

That first article was explosive because it revealed a failed Salwa Road project in Qatar. It attracted 34 comment, mostly from within UEM Group and sent "tremors" up to Mercu UEM.

This blog went on a hot pursuit a month and comments reached more than 100 till a meeting was arranged with UEM Chairman Tan Sri Tajuddin Ali. In the meeting, Tajuddin promised to solve the Qatar road problem in two years. He promised to hand hold the new CEO.

Ample time have been given. Tajuddin Ali did not deliver his promise. The last check with Izzadin, the Qatar matter was still left unresolved. Just like what happen at Sime Darby, it is time for Tajuddin Ali, the Board of Directors and management of UEM and Khazanah to answer to the public.

And we do not see him guiding Izzadin in the right path. UEM was in the limelight for it's dispute with another Khazanah company, MAHB with regard to "delayed" construction of KLIA2. The bigger issue with UEM is the takeover of Sunrise that raised eye brow.

Khazanah operational failures

UEM will always be on our radar because Proton, MAS and UEM were the three companies Khazanah was supposed to turnaround. The incompetent and no deliverable CEO Tan Sri Azman Mokhtar promised publicly in many public forums during Tun Abdullah reign.

They failed to do all three. Khazanah have failed in all start-up of strategic value.

The reason behind their failures to turnaround companies and start-ups is that as Fund Manager CEO, Bankers, and Accountants, they are only tinkering financial numbers but never serious about operations to generate profitability in the long term.

In their turnaround effort, Proton was subtly being planned for closure by then MD Dato Azlan and eventually after much pressure, Khazanah washed their hands by first rigging the price in the market up then off-load it to Tan Sri Syed Mokhtar at an inflated premium.

Yet Syed Mokhtar is being villified for monopolising businesses but kept quiet on the monopoly by the Kuok, Yeoh, Cheng, Lim, Tan, etc.

MAS has not only not turnaround but Bina Fikir, Penerbangan Malaysia Berhad under Khazanah themselves and Tun Abdullah's family seemed to be helping themselves as part of ensuring it's demise.

The status of UEM is not known with UEM World or now UEM Group delisted thus the true picture of the group is only known to Khazanah.

Only the crown jewel, UEM Land was kept listed because Nusajaya is profitable. As the CEO said, HDB flats are sold at RM1 million, thus no reason the prospect for UEM Land not be good. Thus, why the need to takeover Sunrise?

UEM Sunrise merger

On many occassions, Izzadin repeatedly said that the merger with Sunrise was about securing expertise in high rise luxury building.

Although raised into believing "Melayu boleh" and GLC was about building Bumiputera human capital, that reason and intention seemed reasonable on the surface. And perhaps it was the changing times.

The vogue then seems to be of GLCs taking over property companies but let the vendors or previous owners run the show. It happened in the Sime Darby takeover of P&O, PNB takeover of SP Setia, etc.

To the more seasoned corporate players, it raised eye brow because UEM has Faber as subsidiary, Sime Darby had Sime UEP and PNB had lots of property companies to rely on for expertise. If they only want the milk, why buy the whole cow?

The Sunrise that they tookover was not under the control of Dato Alan Tong that build the company to where it is but led by Anwar Ibrahim's crony, Dato Tong Kooi Ong. Tong holds 25% and the rest of the 40% block is held by DAP Penang friendly, Dato Danny Tan and Dato Allan Lim.

The November merger was unravelled in November 2010 with glowing prases by The Star. It marked Izzadin's presence in UEM but the suspicion is that it was Khazanah orchestrated and CIMB had their cut in it.

Conveniently, the PKR-friendly, The Edge highlighted the strength from the combined asset of over RM5 billion.

Khazanah media machinery may have promoted it as New Economic Model-compliant and in line with the vision of then new Prime Minister Dato Seri Najib. The Bernama report can be found on Iskandar Malaysia website here.

Most media highlighted the merger as a merging of brands. Read here.

Who Took Over Who?

By February 2012, The Star columnist Angie Ng hinted here that the merger is not as seamless as it seemed to be.

The integration and transition for the merger of a GLC and township developer with a company known for luxurious high rise condo and high rise integrated project had it's problems.

But then UEM Land changed name to UEM Sunrise on June 17, 2013 [read Star Property here] and that gave away bad vibes. Instead of a takeover and UEM dictating the merged entity, it was becoming clear that Tong was dictating the show.

Tong made money from his personal equity in the merged entity. Although the former Chairman of Sunrise resigned as Director of UEM Land, his team seemed to run the show operationally at UEM Sunrise.

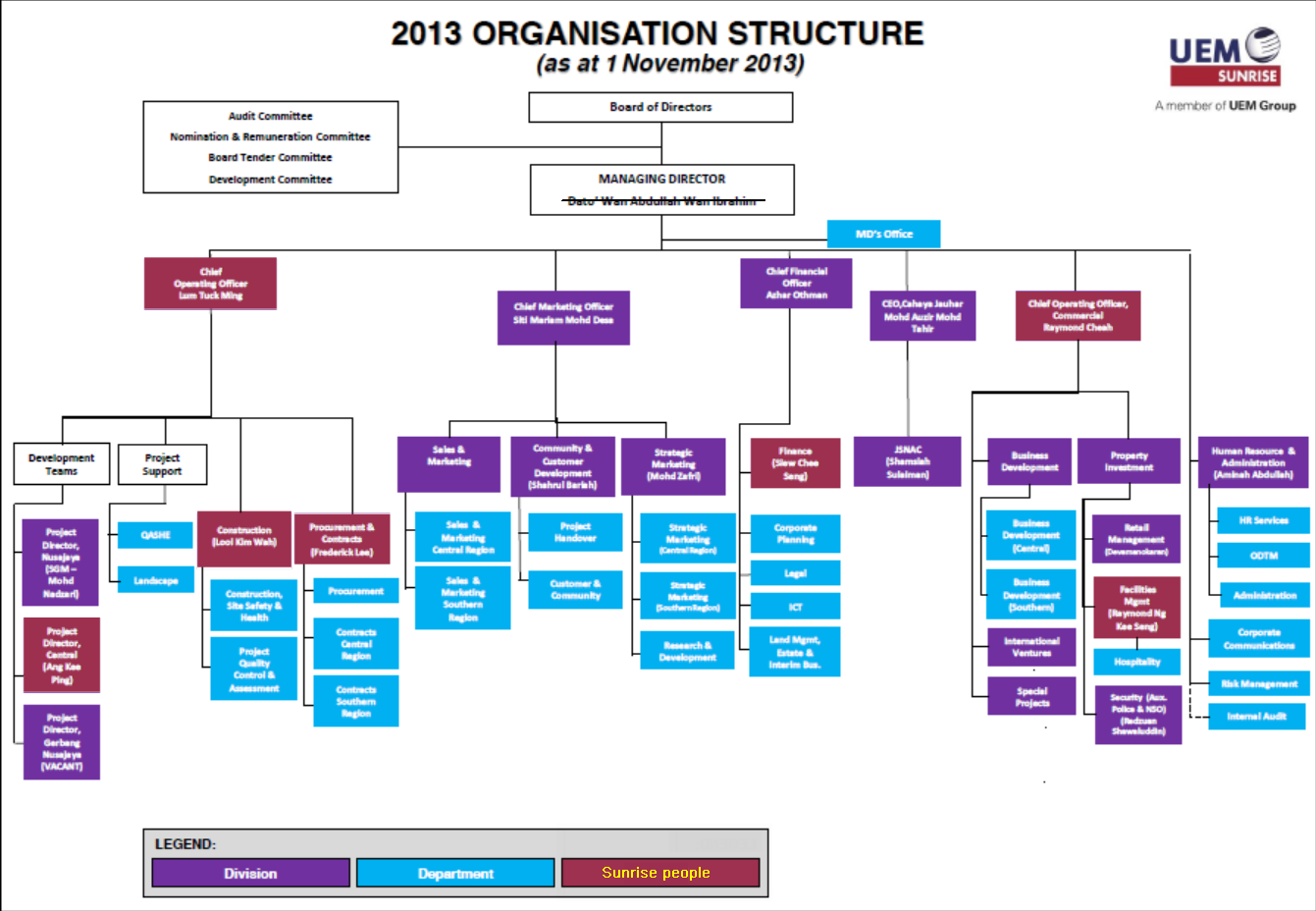

As of November 2013, Tong's people dominate operations and business development with Lum Tuck Meng as COO and Raymond Cheah as COO for Commercial or in other words, Business Development.

When the merger took place, Raymond Cheah was merely a Senior Manager, but rose four steps to COO to replace Zakir Omar who was formerly the long time CFO from the days of Ahmad Pasdas.

| Zakir seen with the late CEO |

Zakir was quite prudent and cautious. He rejected deals even at 60:40 confidence level, thus may have got in the way of Tong.

A representative of Sunrise on the Board of Director by the name of Oh Kim Sum was assigned as Zakir's assassin to discredit him. Eventually Zakir was asked to resign within 24 hours notice.

Under Raymond, UEM Sunrise undertook lots of strange businesses and international projects. More on that in the subsequent Part 2.

Zakir's position was replaced by the current CFO Mohd Azhar Osman, who came from Proton. Yes, someone with the expertise in managing the financial affair of a carmaker now manage the financial affair of a property company.

The Chief Marketing Officer, Siti Mariam Mohd Desa came from DRB Hicom.

Unless, the CEO of Cahaya Jauhar, Mohd Auzir is from within UEM, management of UEM Sunrise are made up of outsiders and Sunrise people.

Sunrise people are one of the three Project Directors, and head divisions in charged of Construction, Procurement and Contract, Finance and assisting the CFO, and Facilities Management.

The latest heard is the Project Director for Central, Ang Kee Ping was promoted to be another COO, Development, thus the three COOs are all from Sunrise.

CEO, Dato Wan Abdullah passed away recently at the end of February and the position still remain vacant. Will it be filled up by one of Tong's COOs?

By the look of it, Khazanah Nasional had made UEM look three times stupid.

They bought a company and the shareholders of the acquired company made money. The management of the acquired company remained in management. The way they are positioned, the management team of the acquired company would eventually control the company.

Logically, will it mean the "Sunrise" people will continue to make money at expense of GLC UEM?

In Part 2 tomorrow, it will be about worms UEM swallowed from the cow bought to only get the milk.