The first day of GST was extremely chaotic.

Our scheduled meeting with our web designer was cancelled. He was too swarmed with GST system issues that he had to miss lunch and expect to be back near midnight last night.

The nearby Mini Market which has a payment system couldn't accept any utilities payments yesterday. System is off due to GST. Better come back tomorrow.

"Hari pertama GST ini gila ... Macam mana Nescafe kena GST tapi Milo dan Horlick kena?" he complained.

"Najib dan Rosmah suka minum Nescafe ke?"

Endless complains

We gave up the idea of going to a nearby Pusat Bandar to pay TNB and Unifi. The traffic is usually ridiculously jammed. Too many cars and too little parking available. All open spaces slotted for parking is under development.

In the meanwhile, our smartphone was endlessly blinking signals of WA groups, FB and Twitters updates of GST abuses. Consumers were sharing on the social medias of Seven-11 charging GST for phone card top-ups which turn out to be different policies for different telcos. Only CELCOM is not charging GST.

That claim of not charging GST got Mydin under criticism. GST "expert" and spokesman, Dato ahmad Maslan promoted and praised Mydin for not charging GST. It turns our they did charge GST.

Mydin revised the price down so as to make the net price after adding GST comes out as GST not charged.

Mydin could be just seizing on the commotion to get publicity. With GST imputed in his system, it will be a matter of time he will charge GST. Mamak are so calculative and not so straight so he must be up to something. But, this is not accusing him as a cheat. The man is quite religious and ethical.

The complain yesterday was shops issuing receipt which include GST charges but did not dosclose ther GST registration number. It means they are not registered to collect GST.

Consumers should refuse paying the GST. Should they are forced to do so by waiters the size of Mr T surrounding them, pay it but report them to Customs or KPDNKK. There is supposed to be hotlines and war rooms numbers for public to complain.

Conspiracy

|

| An allegation that suspicously happening |

The big complain yesterday had been of all shops, especially Chinese shops, charging GST on all items including the zero-rated items.

Two issues there - firstly, there is no GST for zero-rated items and secondly, where is the 4% net effect of 10% for removal of SST and 6% charged for GST? Some items had no SST previously so it will automatically see rises.

However, the prejudice against Chinese shops arise from rumours that DAP had directed Chinese traders and shops to not reduce prices when oil price decrease temporarily BUT increase price without sympathy whenever the opportunity arise.

The comspiracy theory says that the Chinese taikos have agreed to do so to sabotage GST and make government look bad. The tentative proof allegedly is petrols at Chinese-owned Petronas stations are charged for GST.

It is an open secret that Chinese businessmen are not happy with GST. By registering for GST, they will end up having to declare their real taxes. Chinese shop keepers hardly pay income tax or pay minimal by having few sets of accounts - one for Income Tax, two for banks for loan purposes and three the real one.

Some tried to get around GST by registering few companies and keep annual revenue of each company below RM500,000 each. While some close shop out of fear their past records being tracked, thus end up paying their properties away. This was the one Lim Guan Eng hyed of a 60 years shop closing up in Penang.

There many layers of value added tax by manufacturers, distributors, wholesalers etc charged but the GST can be refunded.

By right, price increase should be limited to 6% for consumers. Businessmen being businessmen, they added on all money outlay into the retail price. The rebate they will then pocket. Same with the case of service charges being GST-ed, the net effect for consumers are more then 6% and in some cases more than 10%!

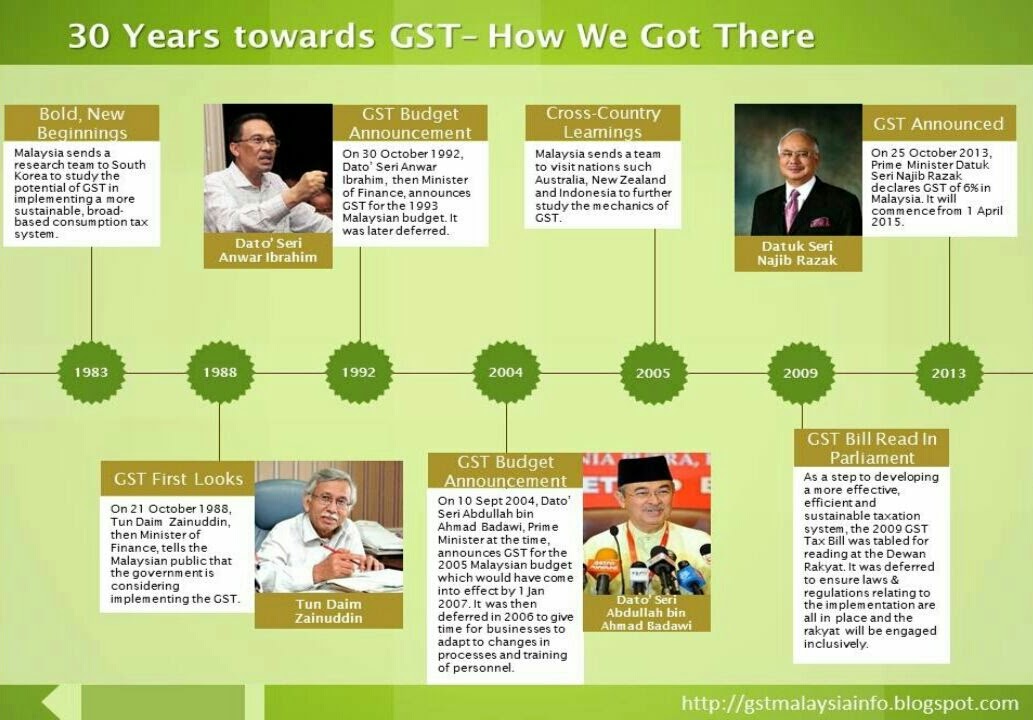

Unlike in Singapore, everything are charged for GST but our government are more humane and generous. Basic daily requirement are exempted and this only complicates the system. Yet the PKR people took up GST as their crying call despite then Finance Minister, Dato Seri Anwar Ibrahim agreed that GST is a fair and efficient tax system in 1993.

Unready to enforce

The GST had been planned as far back as during Tun Daim's time as Finance Minister but delayed several times and only Dato Najib has the political will to carry it out.

Still Tun Mahathir and Tengku Razaleigh all asked for it to be postphoned. Tengku Razaleigh claimed the economy is not in a good situation to implement it. He could be looking at the oil drop as the factor.

Tun Mahathir may be looking at it politically and operationally. Dato Ibrahim Ali already echoed his view to say that BN could lose as a result of GST. His economic treatment was not made known.

A friend felt that Tun Mahathir asked for the delay because he had no confident in the government readiness and the ability to enforce.

KPDNKK MInister Dato Hasan Malek admitted his Ministry is short of staff.

Although he turned around to say ready for political face saving to PM who said Customs has 13,000 staff to monitor GST, Hasan already presented the fact that there are only 3,000 custom staff to carry out enforcement.

Singapore assigned 50 companies to one GST enforcement officer. Malaysia have 300,000 regitered companies.

KPDNKK failed in their monitoring diesel leakage in their Ops Titik. And now to carry out the Price Control Act through out the country?

Weak enforcement is a culture in the Malaysian government machinery. Civil servants love to launch new initiatives, programs and products. It is good on their KPI but weak on implementation and weakest on enforcement.

Idris and Pemandu, what happened? Didn't theystrongly pushed for GST? So, why the silence?

In areas where there are overlap in authority, these government servants end up not doing anything about it. They either avoid conflict or let it linger for years to leave it to Ministers to resolve.

Another big problem with GST is the poor dissemination of information. Major part of the problem is the public attitude to not bother till the last minute. Agencies have been on a campaign drive to explain about GST for 17 months.

Unfortunately there are agencies that merely focus on UMNO divisions instead of public groups thus expecting the UMNO Information machinery to do their work. Why would the UMNO Divisions bother?

Even during by elections and oppositions having political rallies in their area, they do not bother to respond. Let alone to do for GST.

Yet some expect UMNO Division to play the monitoring role. Kena suap terus diam....

Some RM17 million was spent but for the last one month something was missing in the mainstream media that Tan Sri Rafidah Aziz was heard to come out of retirement and scream on FB.

The hype could only be felt towards the last two weeks. Even that is to respond to opposition lies, spin and manufactured allegations.

All for it

For what the allegations made against GST by opposition, GST make economic sense. Having experienced New York state's 7% sales tax and City's 9% tax, it's nothing new. If the political side can be addressed, it is a matter of adjustment.

Malaysia have some 13.3 million voters but only 1.7 million pay income tax. For a country that rely a lot of revenue from tax, some 65% is derived from Petronas and GLC. Corporate is around 25% and individual 10%.

High paying expatriate is included in the 10% and that makes it ludicrous for Malaysians to argue politics and public policy as taxpayers or voters. Government machinery to help the people is not paid by the people but money raised by government machinery!

It is only high time that Malaysia join the 169 nations to implement consumption tax. If anyone disagree, they can go migrate to any of the 40 countries mentioned by Rocky here. Nepal also pay GST [read Hantu Laut here].

Bigdog has another angle on the need for GST here.

However, government should not have done it at one go. There should be a gradual implementation process by starting on a certain class of goods and services first. Then, followed by another and another. That way the system can be gradually adapted to bit by bit.

If not, start with 3-4% first as to ascertain the impact and not affect the consumers and business too drastically.

Now that consumption is taxed, government should look towards the other side of the consumption-investment matrix. It is time for investment tax.

If rakyat have to pay for their consumption, FDI, capital gain tax and other income and profits derived from stock market or any form of investment should pay tax too.

So it is bad for the market. Since rakyat had to suffer the consequence of paying GST, capitalist and those with axcess cash to invest should pay their fair share of the tax burden and stop hiding behind their capital gain.

Capital gain on the stock market hardly help the economy to spur jobs, products and services, technology etc.

Tight cashflow

Taking about suffering, Ahmad Maslan or even Hasan Malek and many other politicians love to talk about GST is good for the country.

Over the last few nights, we have spent time with few friends in finance, accounting, tax and government enforcement agency. One common concern arise and it is in conflict with what Mat Masan said. Off course, many of what he says are not right but only pleasing to the ears.

Some politicians got spinned to say GST help to pay for government salary, help pay for government over spending, Government jet and even Najib and Rosmah's daughter's wedding.

The concern now is about the term input tax and output tax. Input tax will be the GST collected and paid to government. That will take sometime.

Output tax will be the rebate to pay manufacturer, wholesalers and many layers of supply chain.

If output tax is to be paid immediately since it is online, Government will end up paying upfront and instead of being good for Government, they will be a serious deficit in Government cashflow. It is believed to take 3 years till Government cashflow will be in surplus.

According to the Star yesterday, government is expected to receive RM23.6 billion from GST but after netting off for foregone RM13.8 billion SST, RM3.8 billion exempted goods and services, there is only enough to pay for RM4.9 billion of BR1M. Net gain on paper only RM690 million for a heavy political price.

An accountant and corporate player disagree. The rebate will come as tax credit so cashflow should be OK.

Politically, will the voters be happy with BN Government? As for last night at one GST session by JASA at a public university, it did not go down well with the students.

They seem to echo Rafizi Ramli's arguement.

For the future, JASA's new DG, Datuk Dr Puad Zarkashi should consider hiring Rafizi to do "penerangan". Students and youth hear him better than the politically naive Azwan Bro.

Almost every other ex-PKR and reformasi are given roles to do "penerangan" and propaganda for UMNO and government. Someone up there seem to think there is something special in their losing ways.

Without even campaigning for GST, MOF Communication Director, Ezam Mohd Nor must have a magic formula to solve the possible political fallout without having to utter a single words.